Holiday Accrual in Employee Definition

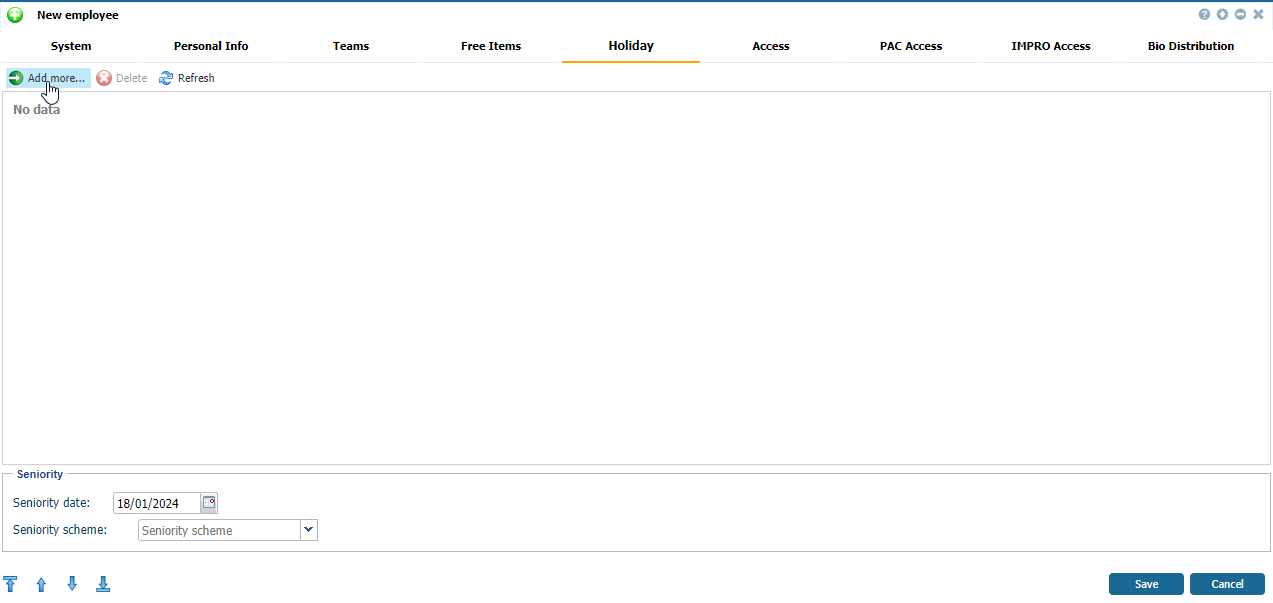

Holidays accrual for employees can be defined/changed in Configuration - Employees - New/Edit - Tab Holiday. To add a new holiday definition, click  .

.

|

|

Adding a holiday definition in Employees in Astrow Web

|

|

|

Before defining holidays, you need to define holidays counters. For more information, see Holiday Counters Definitions for Holidays Accrual.

|

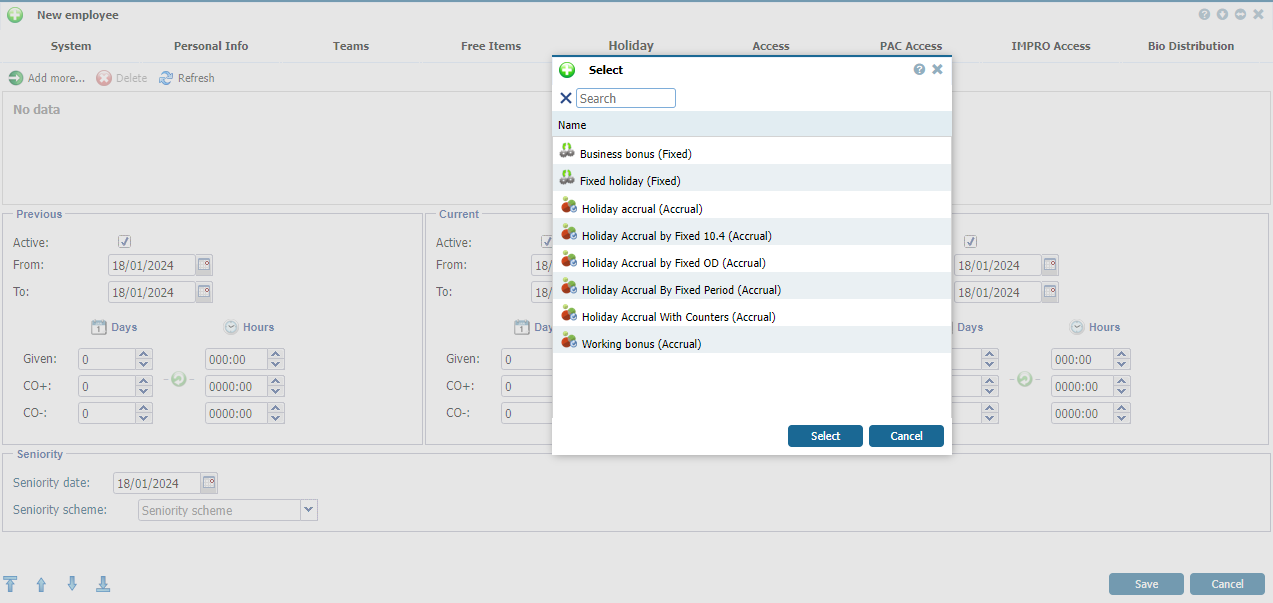

Select the holiday you need to define and click Select (see Select Holiday Window).

|

|

Linking a holidays accrual counter in Employees in Astrow Web

|

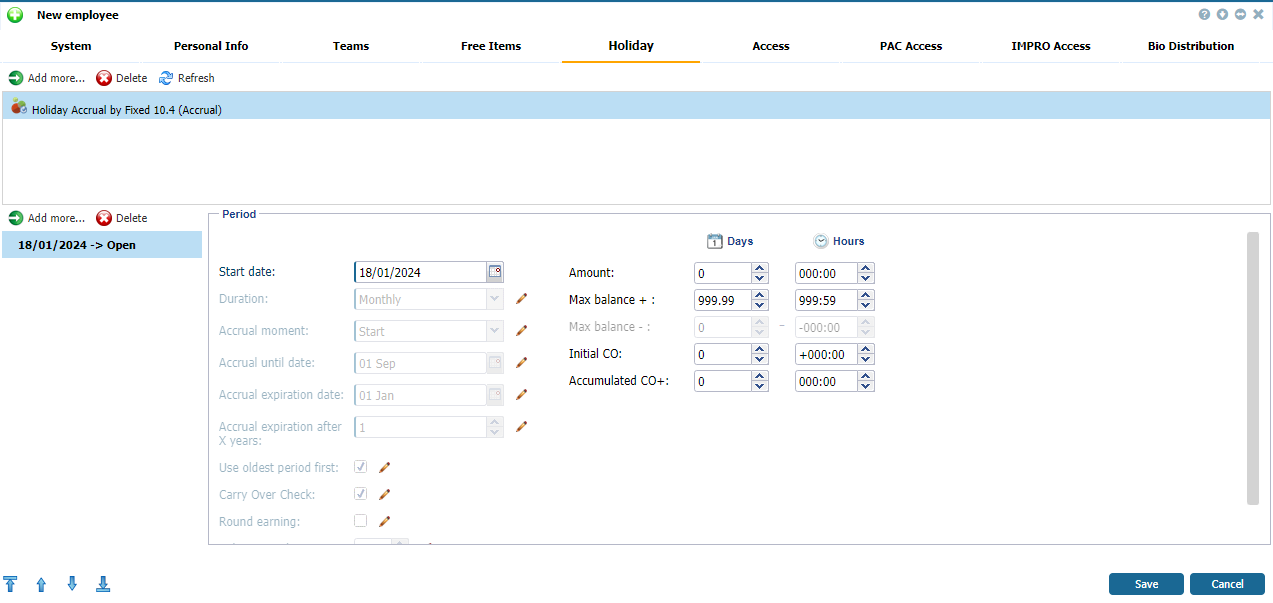

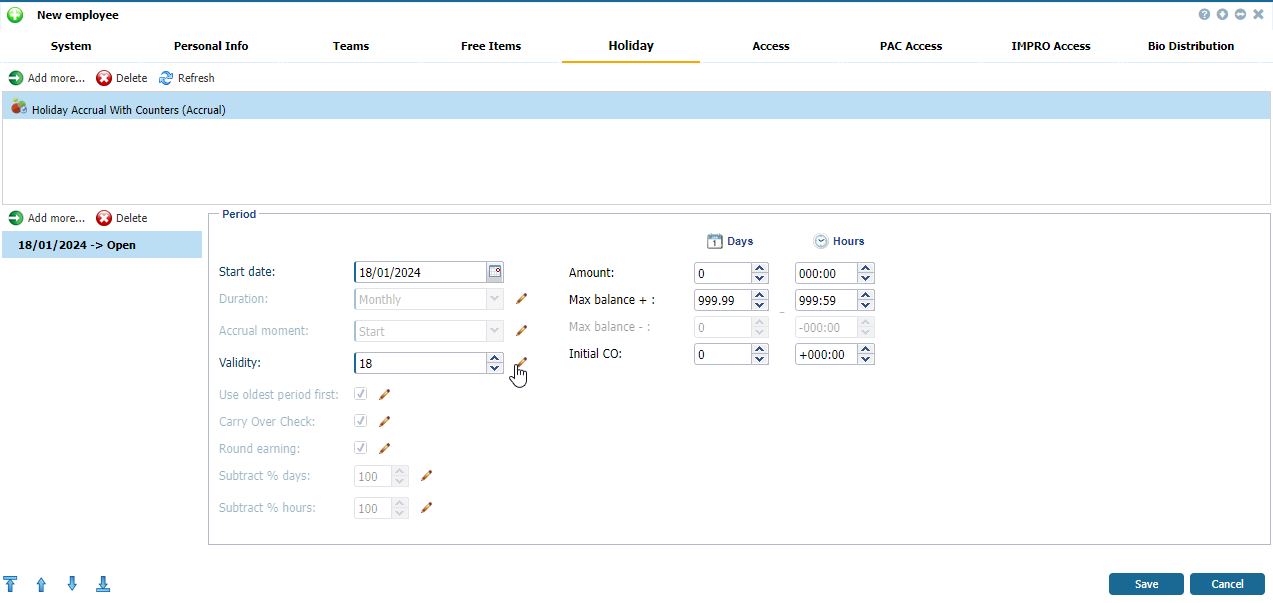

Now you can define the holidays accrual:

|

|

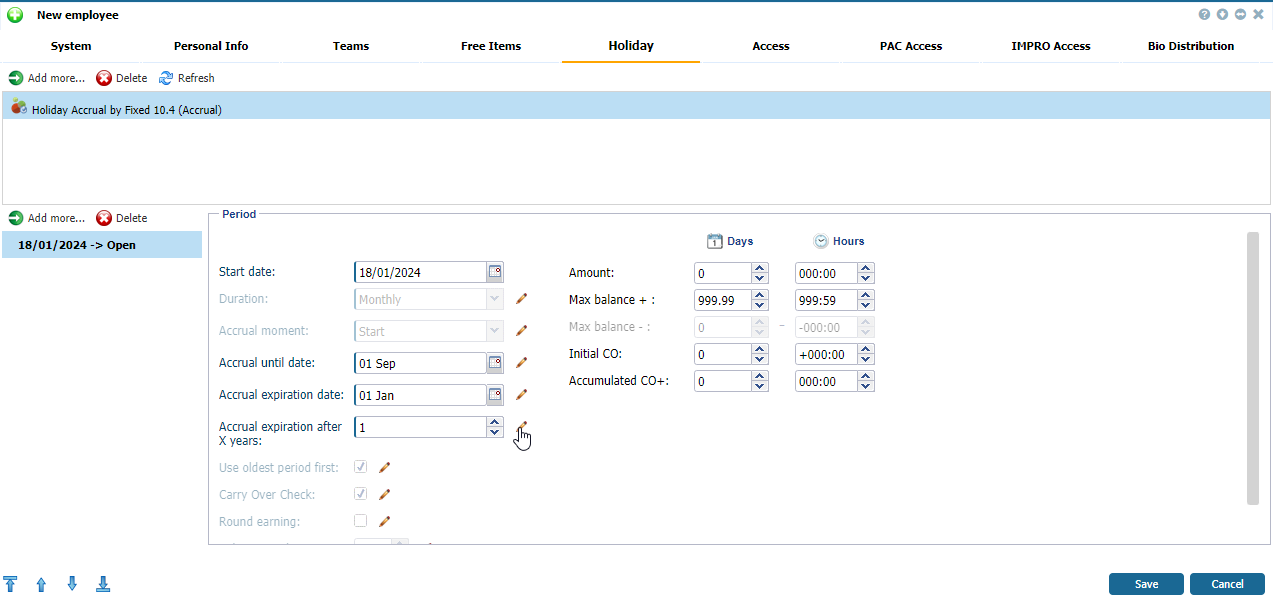

Defining a holiday in Employees in Astrow Web

|

|

|

All definitions in the Employees holiday tab will rewrite the general definition in Configuration - Holiday Settings! To rewrite one or more definitions, click on the pencil

|

Start date: The start date for holidays accrual.

Duration: The period to be taken into consideration for accrual. It can be Weekly, Monthly, Quarterly and Yearly, starting with the date/day of the week set for holiday accrual at Start date. If it is set Weekly, will always take into consideration the day of the week of the Start date in the Employees definitions. For Monthly, Quarterly and Yearly, it will take the start date counting on a monthly basis (e.g. if the start date for monthly is 02.01, the next period will start with 02.02).

Accrual moment: Here it is decided when the accrual starts, at the beginning of the period or at the end.

Validity: There are two types of calculation, depending on the holiday definition assigned to employee.

Type 1. Holiday validity by no. of periods

The number of periods set at Duration. E.g: if the parameter By no. of periods set is 18 and the Duration is monthly, the validity will be 18 months; if the parameter By no. of periods set is 2 and the Duration is yearly, the validity will be 2 years, always starting from Start date. Validity is the maxim period within the holidays accrued can be taken. After the period expires, the holiday cannot be taken anymore even if carry over is allowed.

|

|

Definitions for a holidays accrual counter by no. of periods in Holiday settings in Astrow Web

|

Type 2. Holiday fixed validity

Accumulating holidays can be set to expire on a fixed day and month. These new options can be set in the holiday definition by checking the Use fix validity end. The Accrual expiration date must be bigger than the Accrual expiration date.

On each period specified by Duration, the amount will be accumulated until Accrual until date. When the Accrual expiration date is reached, the entire accumulated data will be lost without the ability to recover. If there are negative corrections or absences taken between the Accrual until date and the Accrual expiration date, the expiration amount will be affected.

-

Accrual until date: The yearly deadline for accumulation holiday, e.g. December 31.

-

Accrual expiration date: The yearly deadline for consuming the holiday from the previous period, e.g. March 31.

-

Accrual expiration after X years: Currently, the possible values are 0 and 1. It works with Accrual until date and Accrual expiration date. If 0, the Accrual until date and Accrual expiration date remain the same. If 1, one year is added to the Accrual until date, and the expiration date becomes Accrual expiration date + 1 year.

|

|

Definitions for a holidays accrual counter with fixed validity in Holiday settings in Astrow Web

|

Subtract % days: This option is helpful when calculating the holiday for part-timers. It subtracts a percentage from the time accrued.

Subtract % hours: This option is helpful when calculating the holiday for part-timers. It subtracts a percentage from the time accrued.

Use oldest period first: If checked, the holiday will be subtracted firstly from the oldest period accrued.

Carry over check: If checked, the option allows holidays to be reported up to the value mentioned as Max balance (+/-). However, it can only be taken with the period set as Validity.

Round earning: Rounding is applicable only for the fixed period Monthly and only for the value 2.08 accrual per month up to 1 year. E.g. 2.08 days x 12 months will be rounded to 25 days.

Days left positive: If checked, the holiday will be taken in days, and the balance can not go negative.

Days left negative: If checked, the holiday will be taken in days, and the balance can also go negative.

Hours left positive: If checked, the holiday will be taken in hours, and the balance can not go negative.

Hours left negative: If checked, the holiday will be taken in hours, and the balance can also go negative.

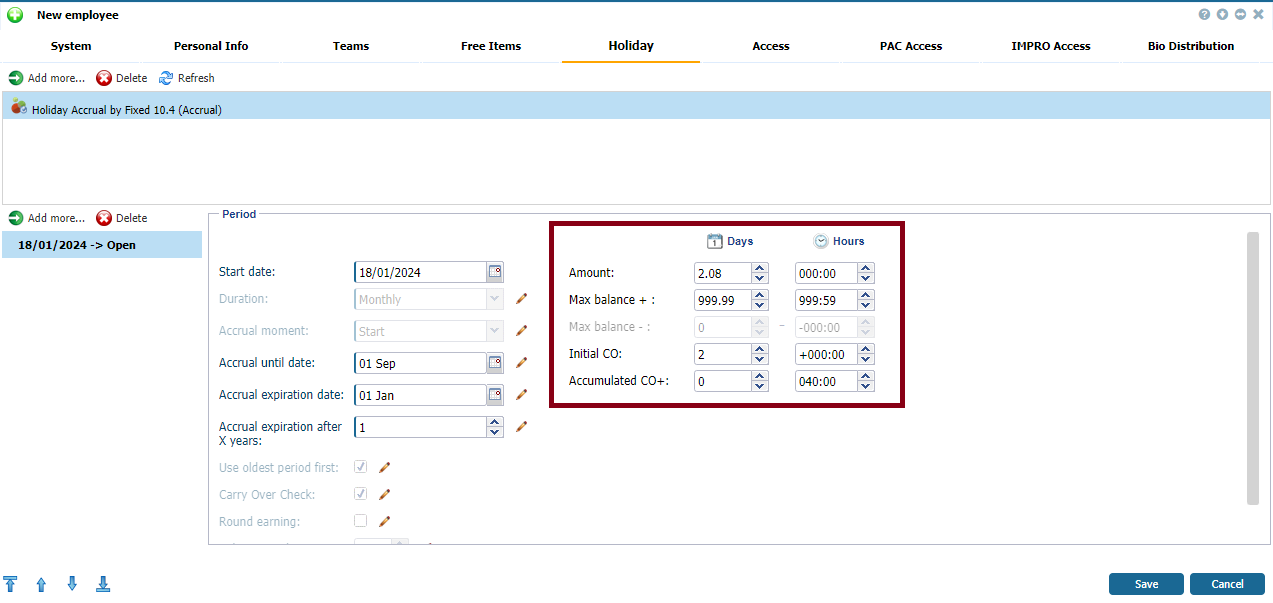

Individual employee definitions for holidays accrual

|

|

Defining a holiday in Employees in Astrow Web

|

Amount: The holidays (days/hours) to be added to each period accrual. The amount defined here is added periodically.

Max balance (+/-): The maximum carry over (positive or negative) to be accumulated from period to period.

Initial CO: Extra holidays inherited from another company or another type of calculation - it will be added only once.

Accumulated CO: This option is activated only when using the accrual with fix validity. This is a manually set value for the holiday to be carried over after the expiration date.